I. Description

Over-the-counter book-entry bond (“OTC book-entry bond”) is a book-entry bond investment product that ICBC offers to customers through e-banking and domestic outlets.

OTC book-entry bond varieties are the bonds that are approved by regulators (such as PBOC) to be traded at commercial banks and put under custody of bond registration, custody and clearing agencies (such as China Government Securities Depository & Clearing Co. Ltd. and Interbank Market Clearing House Co., Ltd.). Customers are not required to hold the certificate, but only open a custody account at the bond custody institution to record the holding. At present, the counter-based bond varieties include issued treasury bonds recognized by the issuer, local government bonds, China Development Bank bonds, policy bank bonds, and newly issued bonds (targets including counter-based investors) (the details are subject to the varieties actually offered by ICBC).

The counter-based trading types include spot bond trading and other trading types recognized by the PBOC (the details are subject to the varieties actually offered by ICBC). It can be divided into continuous and non-continuous trading products based on whether continuous trading is allowed. Continuous trading refers to that, within a natural week, except for holidays, the trading activities can continue during the trading hours from the designated start time in the first working day of the natural week through to the designated ending time in the last working day of the week. Refer to the announcements under “New Products” under the Bond channel on the official website (http://www.icbc.com.cn) for the detailed types of bonds allowing continuous trading.

Further information on the bond category, issuance size and offering period will be announced by the issuers and ICBC through related media.

II. Target Customers

The product is applicable to personal customers with full capacity for civil conduct at home and abroad.

III. Functional Features

1. High security: so far, all OTC book-entry bonds are bonds with sovereign credit rating or quasi-sovereign credit rating, involving low credit risk.

2. Good returns: stable interest income can be obtained upon maturity; and spread income of trading can be obtained by seizing the favorable opportunities brought by market price fluctuations.

3. Sound liquidity: customers can buy or sell the bonds at any time during the trading hours, and real-time clearing of funds can be realized in the trading to meet the customers’ demand for fluidity.

4. Low threshold: both the threshold for a single transaction and the minimal increment unit are RMB100 face value.

IV. ICBC Advantages

1. Rich variety of bonds: All book-entry treasury bonds of all key terms are covered. ICBC is the first to issue China Development Bank bonds and China Export-Import Bank bonds.

2. Competitive price: Supported by ICBC’s expert team and experience, ICBC can provide competitive prices to customers.

3. Long trading hours: ICBC has exclusively introduced the OTC continuous trading service, by which sale around the clock during the offering period is provided for all bonds, and continuous trading of products around the clock during the trading period is allowed.

4. Broad service channels: ICBC can provide account opening and transaction services to customers via multiple channels such as e-banking (including internet banking and mobile banking) and outlets, and the business process is simple, fast and efficient.

5. Value-added services: historical breakdown enquiry and custody transfer can be realized; and you may apply for pledge loans by the pledge of bonds.

V. Product Price

The ICBC quotes to the customers with reference to the price trend of interbank bond market, the market liquidity and trading positions into comprehensive consideration, and has the right to adjust the trading quotations at any time according to actual market situations. OTC book-entry bonds are traded at net price and cleared at full price.

VI. Qualification

Personal customers can log in the internet banking or mobile banking to sign up for the business, or at ICBC outlets with valid identity documents such as ID card (in the case that an agent is assigned for signing up for the business, the valid identity documents of both the applicant and the agent shall be provided).

VII. Application Process

The customers can log in the internet banking or mobile banking, or go to ICBC business outlets to read through the Description of ICBC OTC Book-Entry Bond Products, undertake to abide by the Rules of ICBC for OTC Book-Entry Bond Transactions and sign the Protocol of ICBC for OTC Book-Entry Bond Transactions; after a customer has assigned the capital account for bond trading and paid the account fee for OTC book-entry bond, ICBC will open a custody account of OTC book-entry bond to activate the business.

VIII. Service Channels and Hours

i. Sign-up time

E-banking channels: 0: 00-24: 00 from Monday to Sunday.

Outlets: actual business hours.

ii. Trading hours

Trading hours of e-banking channels (applicable for subscription of issued bonds, subscription of rolled-over bonds, spot bond trading and bond custody transfer):

1. Subscription of issued/rolled-over bonds

From 10:00 on the start date to 16:30 on the closing date for bond issuance/rolling-over.

2. Spot bond trading/bond custody transfer

(1) Continuous trading products

Monday: 10:00-24:00;

Tuesday to Thursday: 00:00-24:00;

Friday: 00:00-16:30.

(2) Non-continuous trading products

Monday to Friday: 10:00-16:30.

Trading hours of business outlets: Monday to Friday: 10:00-16:30 (applicable for subscription of issued bonds, subscription of rolled-over bonds, spot bond trading, bond custody transfer, and non-transaction transfer of bonds).

In the case of public holidays, actual off days as adjusted based on national regulations, trading suspending days as specified by regulatory agencies, or owing to unforeseeable, unavoidable and insurmountable force majeure events such as natural calamities and war, or under the effect of various international political, economic or emergent factors, or emergencies such as communications failure, system failure, power outages or trading suspension, or the factors such as financial crisis and changes of national policies, ICBC can suspend the trading of OTC book-entry bonds, and, where feasible, notify customers in advance or in time, insofar as possible, via the channels such as the official website (http://www.icbc.com.cn).

The customers can submit the applications for subscription of issued bonds, subscription of rolled-over bonds or spot bond trading via e-banking channels or business outlets, and fill in corresponding electronic instructions or vouchers as required, so that the e-bank or business outlets can take actions accordingly.

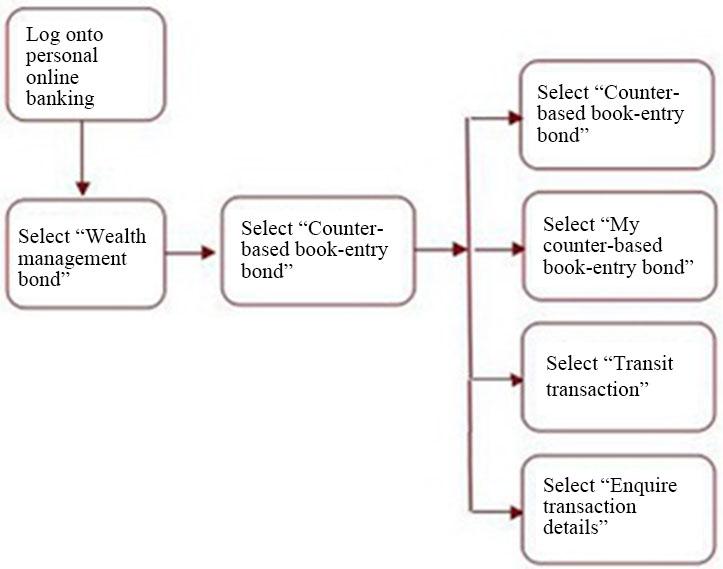

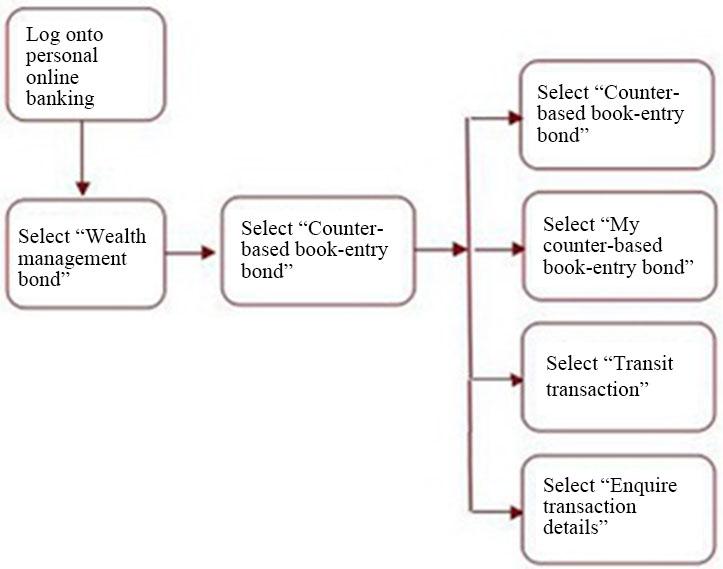

IX. Operation Guide

i. Personal internet banking and mobile banking

ii. Over the counter

After a customer has opened a bond custody account at the counter, he/she shall carry his/her valid identity documents, personal debit card or corporate settlement account to an outlet designated by the Bank, and fill in a Bond Transaction Voucher to handle bond trading, bond custody transfer or other related businesses.

X. Notes

OTC book-entry bonds can provide stable interest income to investors; for the asset allocation-oriented customers hoping to obtain stable interest income from the bonds upon maturity, they can subscribe bonds during the bond issuance or rolling-over period, or buy bonds at the buying price for customers declared by ICBC after the bonds have been listed for transactions, and hold them until obtaining the interest income upon maturity.

The price of OTC book-entry bond is closely related to changes in the bond market; for transaction-oriented customers with certain investment experience and risk-bearing capacity, on the premise of making accurate judgment, they can earn extra spread income by trading of OTC book-entry bonds. The bond price is inversely proportional to the market interest rates; the lower the interest rates are, the higher the bond price will be; and when the interest rates rise, the bond price will fall. Therefore, when the economy is developing rapidly and signs of inflation appears, the market will predict the interest rates to rise, the customers can sell the bonds in hand to avoid financial losses caused by falling of bond price following the rise in interest rates. When the interest rates have actually risen and caused the fall of bond price, the customers can buy in the bonds, awaiting opportunities for taking profit; if signs of recession appear in the economic development, and customers predict the interest rates will fall, they can buy in the bonds, and sell them when the interest rates actually fall and cause the rise of bond prices, thus to earn considerable income higher than interests.

XI. Market Information

Customers can learn market information related to OTC book-entry bonds through multiple channels, such as the counters of business outlets designated by ICBC, ICBC’s official website (http://www.icbc.com.cn), telephone banking (95588) and China bond information network.

XII. Risk Prompt

The trading of OTC book-entry bonds is confronted by various risks, including policy risk, credit risk, market risk, liquidity risk, operational risk, force majeure and contingency risk. Under the effect of various political and economic factors and contingencies both at home and abroad, the prices of OTC book-entry bonds are fluctuating at every moment. Customers should be fully aware of the risks possibly involved in the business, and volunteer to undertake the investment transaction risk caused by price fluctuations.

Note: the information provided on the page is for reference only. Specific businesses are subject to announcements and rules of local outlets.

|