|

I. Definition

Financing service is the service provided by ICBC to satisfy the inter-bank fund facilities that mainly includes: Inter-bank Borrowing, Bond Trading, Instrument Financing, Credit Assets Repurchase, and Corporate Body Account Overdraft.

II. Product Introduction

1. Inter-bank Borrowing (Inter-bank Lending)

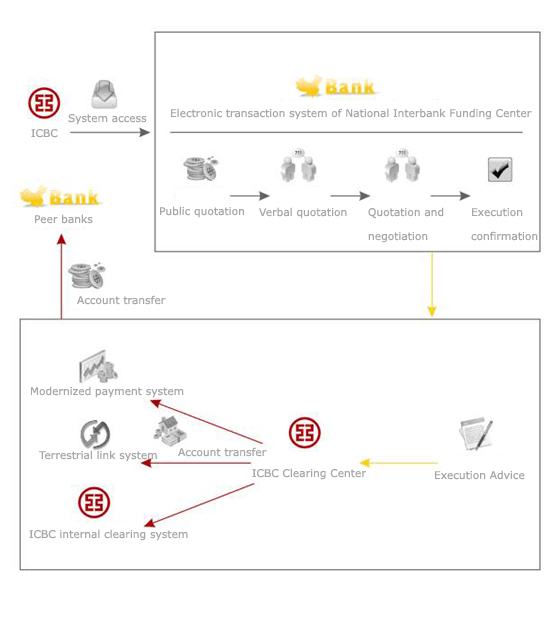

The HQ directly provides or authorizes the branch institutions to provide credit backed short-term fund facilities to peer banks, investment trust companies, and financial lease companies with inter-bank borrowing qualification. The HQ or the authorized branch institution signs the financing contract with the financial institution and extend to the customers the financing products ranging from the overnight inter-bank borrowing to 120-day products. The deals are conducted through inter-bank borrowing market and the borrowing interest rate is determined upon the fund demand and supply and the general market level during the particular period. The fund settlement is done through account transfers. The borrowed fund is deposited during the current day.

2. Bond Trading

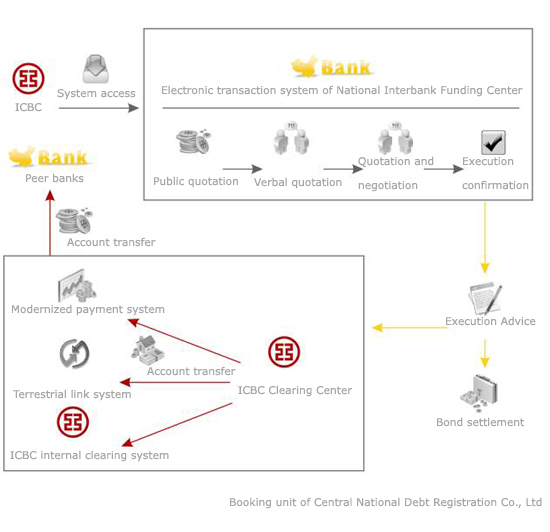

ICBC can enter into the national inter-bank bond market and trade bond repo and spot bond with the peer banks or non-bank financial institutions that signed the bond repo agreement with ICBC. The maximum repo tenor can be 365 days. The bond trading is conducted via transaction system enabled through National Interbank Funding Center. The bond trades not eligible for the transaction system can be completed through written contracts. The trade with the commercial banks is cleared through provision account opened by the parties at the People's Bank of China. The transaction fund with other counterparties is cleared through other account transfer methods.

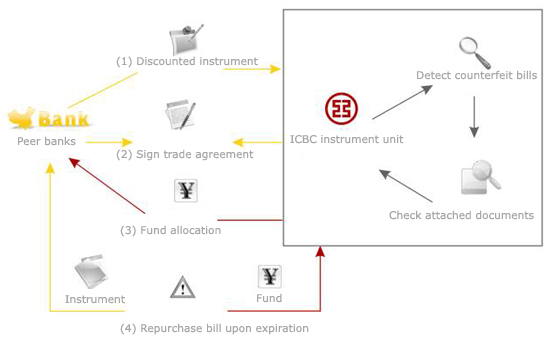

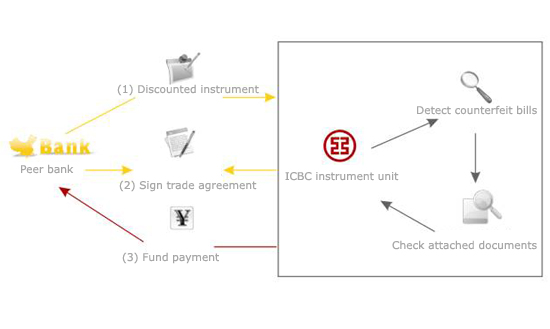

3. Instrument Financing

ICBC provides Instrument Financing for peer banks and other financial institutions with instrument business licenses. The peer banks and other financial institutions may rediscount the instruments at ICBC on the discounted instruments compliant with stipulations of the People's Bank of China for financing purpose. The rediscount transaction includes rebuy, resell, repo and reverse repo. The term of rebuy and resell depends on the date on the instrument with maximum limit of 6 months; the term of repo and reverse repo is negotiated between the trade parties 2 days before the expiration of the instruments. At present, ICBC practices its instrument business through its instruments business office in Shanghai and its instrument sub-units.

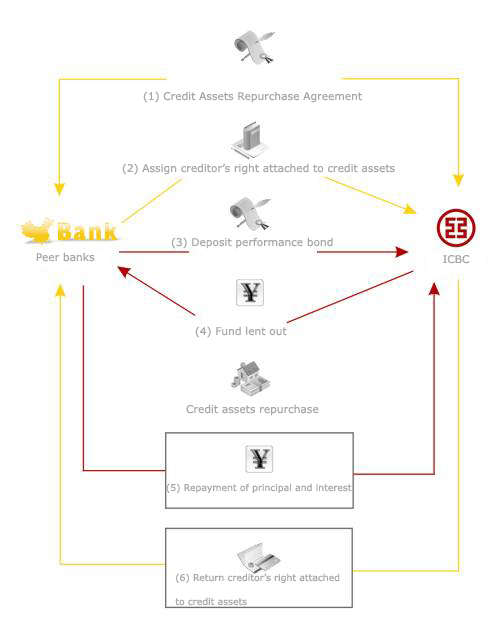

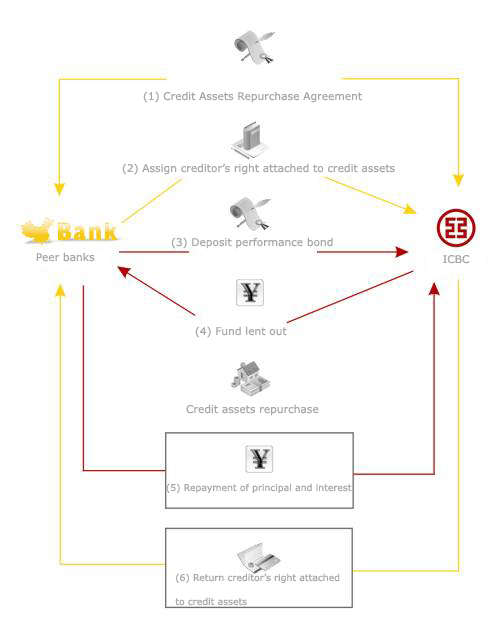

4. Credit Assets Repurchase

ICBC provides Credit Assets Repo service to peer banks with credit assets repo qualifications. The peer bank assigns the creditor's right on legal credit assets in its possession to ICBC for short-term financing as per Credit Assets Repurchase Agreement signed between the parties. The peer bank deposits a definite business guarantee. The peer bank undertakes to unconditionally repay the financed principal and the attached interest upon expiration as per the stipulated interest rate to ICBC so as to buy back the previously assigned credit assets. The maximum allowable term for Credit Asset Repurchase for ICBC is 6 months and the repurchase deadline shall not exceed the earliest due date in the assigned credit assets. The pricing of credit assets repurchase is pegged on the semi-annual refinancing interest rate and is determined according to the risk exposure, market interest rate level and through the both parties' negotiation.

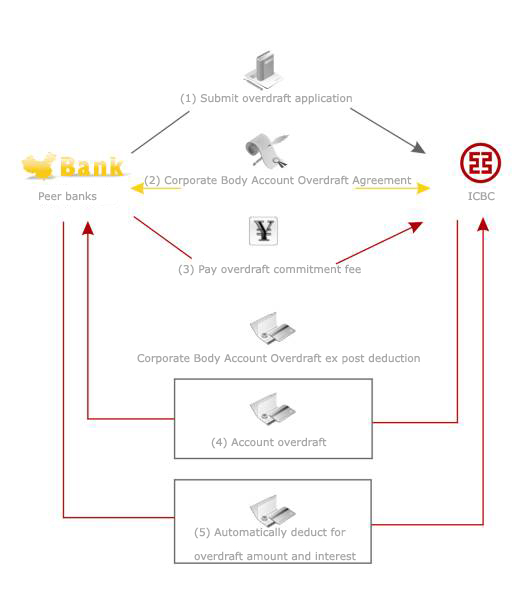

5. Corporate Body Account Overdraft

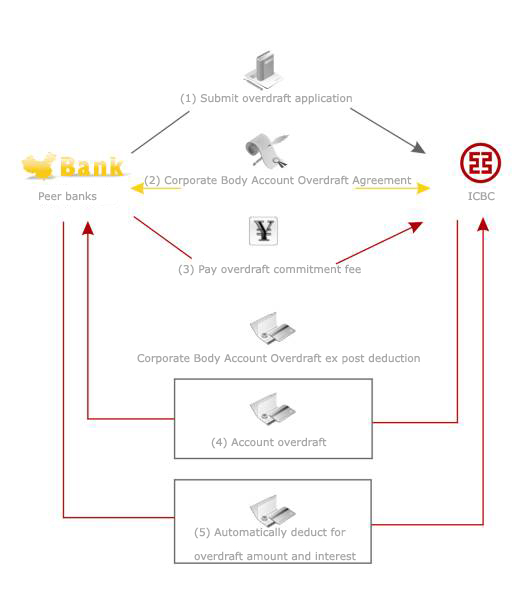

ICBC provides Corporate Body Account Overdraft for peer banks possessing qualifications for corporate body account overdraft. The authorized administering institution of ICBC signs with the peer bank the ICBC Corporate Body Account Overdraft Agreement for Financial Institutions according to the peer bank's application. The peer banks pay overdraft commitment fee to ICBC, and ICBC permits the peer banks for direct overdraft as financial facility when the peer bank's settlement account dries up. The overdraft by the peer banks shall be used to cover the position shortage or interim liquidity need. The fund from overdraft shall not be used for long-term investment, loan, and repayment of principal and interest for other financed funds (such as borrowing and reverse repo). ICBC will negotiate with the peer bank for the overdraft line according to the status of the peer bank, and the line is revolving.

III. Target Client

Peer banks and financial institutions with relevant business qualifications.

IV. Application Condition

The customer shall be qualified for the relevant businesses and obtains credit line from ICBC before application.

V. Solutions

1. Interbank Borrowing

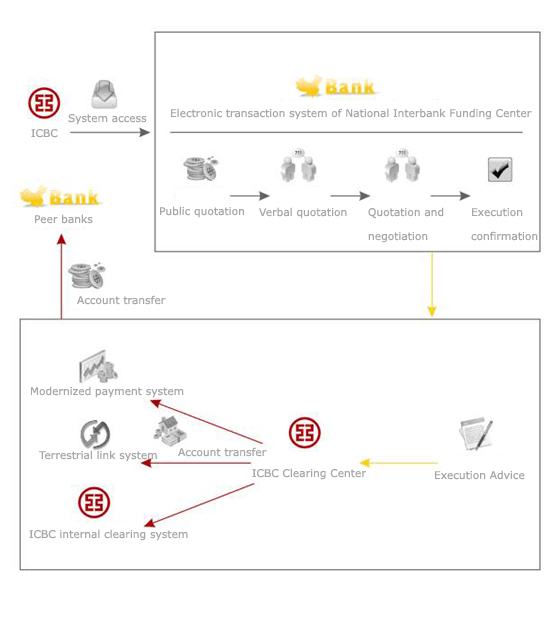

ICBC's interbank borrowing service is mainly conducted through the national interbank borrowing and lending market. The peer bank and ICBC make proprietary quotations and the standardized price seeking through electronic transaction system and decide for the trade and eventually complete the trade. The transaction system prints Deal Execution Advice, which is contractual document of legal force evidencing the transaction between the parties. ICBC and the peer bank clear the fund through provision deposit account opened by the both parties at the People's Bank of China according to the Execution Advice and on principles of independent clearing and proprietary risk taking. ICBC promises the peer bank that the fund available through interbank borrowing will be deposited in the same day.

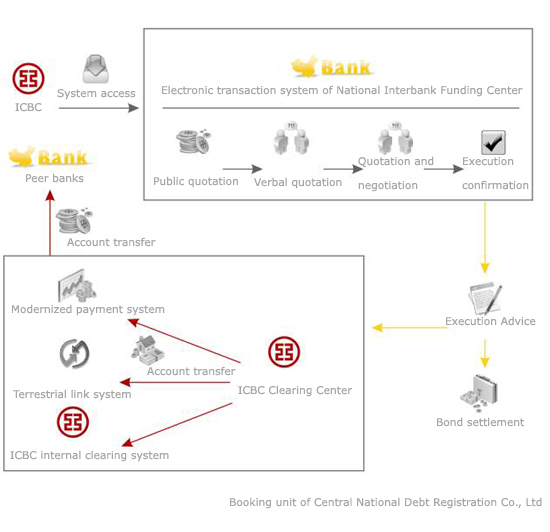

2. Bond Trading

The Bond Trading between ICBC and the peer banks is conducted through the transaction system of National Interbank Funding Center. The peer bank and ICBC make proprietary quotations and the standardized price seeking through electronic transaction system and decide for the trade and eventually complete the trade. The transaction system prints Deal Execution Advice, which is contractual document of legal force evidencing the transaction between the parties. ICBC and the peer bank deliver the bond through bond registration system and clear the fund through provision deposit account opened by the both parties at the People's Bank of China according to the Execution Advice and on principles of independent clearing and proprietary risk taking.

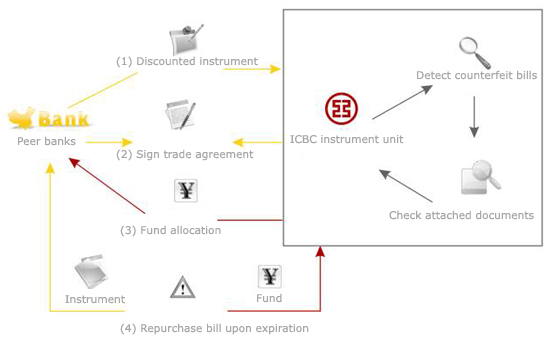

3. Bill Financing

(1) Bill repurchase: The Bill repurchase includes repo and reverse repo. In repo arrangement, ICBC purchases from the peer bank's discounted and unexpired commercial bills and sell the bills back to the peer bank as per stipulated time and price. Reverse repo is arrangement where ICBC assigns the discounted and unexpired commercial bills to the peer bank and buys back the bills as per stipulated time and price. The parties to the instrument repurchase shall sign agreement or contract and the term of the trade is negotiated between the parties, however the term shall exceed 2 days before the expiration of the bill.

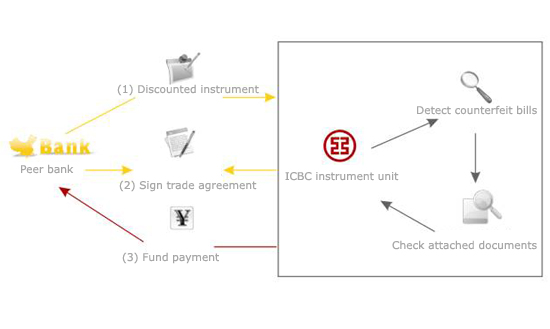

(2) Instrument rediscount: The instrument rediscount includes the instrument rebuy and resell. The instrument rebuy refers to arrangement where ICBC buys the discounted and unexpired commercial bills from peer banks and instrument resell refers to arrangement where ICBC assigns the bought and unexpired commercial bills to the peer banks. The term of rebuy/resell is determined by the date printed on the instrument with maximum length of not exceeding 6 months. The interest is deducted during rediscounting, which simply and promptly completes the transaction procedures at once.

4. Credit Assets Repurchase

The peer bank assigns the creditor's right on legal credit assets in its possession to ICBC for short-term financing as per Credit Assets Repurchase Agreement signed between the parties. The peer bank deposits a definite performance bond. The peer bank undertakes to unconditionally repay the financed principal and the attached interest upon expiration as per the stipulated interest rate to ICBC so as to buy back the previously assigned credit assets.

5. Corporate Body Account Overdraft

The overdraft by the peer banks shall be used to cover the position shortage or interim liquidity need. The fund from overdraft shall not be used for long-term investment, loan, and repayment of principal and interest for other financed funds (such as borrowing and reverse repo). ICBC will negotiate with the peer bank for the overdraft line according to the general status of the peer bank, and the line is revolving. The interest is accrued as per daily basis and the overdraft interest rate is as per the People's Bank of China short-term refinancing rate 3.15% ,plus a spread of 10% or 40% of the rate.

VI. Features and Strengths

In comparison with other domestic banks, ICBC provides more professional and specialized Financing Services for the State-owned commercial banks, policy banks, incorporated commercial banks, city commercial banks, urban and rural credit cooperatives, and other financial institutions on ground of its abundant fund resources, good public reputation, rich interbank experience, and advanced technology in the sector.

|